Credit cards in Norway explained for expats

The fact that there are 2.8 billion credit cards in use globally is an apt testament to the contemporary prowess and future scope of credit cards. If you are yet to jump on the credit card bandwagon, the time has never been more right. So, without further ado, let us look at some easy tricks and tips to choose credit card that fits to your needs in Norway.

Be aware that Borrowing money costs money

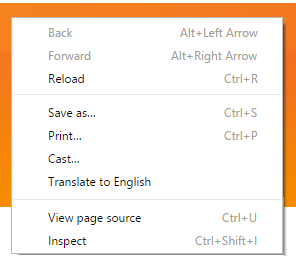

TIP: when you land on a website of a Norwegian credit card provider, make a right mouse-click anywhere on the page (Only works with Google Chrome browser!). A small dropdown menu will appear and then it will say; “translate this page to English” (or any other language). This will make it better understandable and easier for you to make the right decision!

TIP: when you land on a website of a Norwegian credit card provider, make a right mouse-click anywhere on the page (Only works with Google Chrome browser!). A small dropdown menu will appear and then it will say; “translate this page to English” (or any other language). This will make it better understandable and easier for you to make the right decision!List of credit card providers in Norway

All these credit card providers offer different rates and different conditions for different prices. Comparing the specifications of each loan provider can be time-consuming. We have prepared a list to compare below.

| Clear terms | English-speaking customer service | |

|---|---|---|

| › Financier.no | ✓ | ✓ |

| › Resurs.no | ✓ | ✓ |

| › Instabank.no | ✓ | ✓ |

Benefits of getting a credit card in Norway

To the untrained eye, credit cards might seem like a lure or a trap, wherein pre-emptive deposits compel the person to splurge more and ultimately go in debt. However, as we have already mentioned, the mindful use of a credit card in Norway has multiple tangible benefits. What are they? Let us find out!

- When used carefully – by always repaying debts on time, a credit card is a foolproof way to build your credit score. Thus, you get more convenient access to lucrative loans and mortgage deals.

- There are a plethora of credit cards in the market, and by choosing the right card you can even make purchases with 0 percent interest.

- If you are planning on making a massive purchase and do not want to use up all your savings, you can choose to put it on your credit card as a way to defer payment.

- Credit cards also make it possible to pay off purchases in equated monthly installments, ensuring that you are not giving up on a lump sum of money and bruising your bank account.

- Lastly, thoughtful usage of credit cards also comes with wonderful benefits and incentives. The benefits range from cash backs to reward point accumulation each time you swipe your card. You can redeem the reward points in a variety of ways, such as clearing off outstanding dues, air miles, and more.

Difference between prepaid cards and credit cards

Before dabbling into the tips and tricks of finding the best credit card in Norway, let us first understand the differences between prepaid cards and credit cards. To begin with, a prepaid card in Norway is an electronic tool that is not linked to a bank checking account or to a credit union share draft account. Instead, you are spending money you had deposited in the prepared card well in advance.

On the contrary, a credit card is a financial tool through which you are borrowing money. In other words, when you are using a prepaid card, you are spending the money you have already loaded onto the card in advance. In case your prepaid card provider also offers credit on your prepaid card, the latter will have to comply with all the rules of credit cards.

A beginner’s guide to choosing the best credit card in Norway

If you want to apply for a credit card in Norway, following the simple steps given below can help!

- Check Your Credit:

The first step is to check your credit card and gauge what credit offers you might be eligible for. The better your credit score, the greater the chances of being approved for cards with more exciting and lucrative perks.

- Recognize the Type of Credit Card You Need:

The second step is to understand which type of credit cards are most relevant to your situation. Usually, there are three types of credit cards:

- Cards that assist in improving your credit score when it is damaged

- Cards that save money on interest

- Cards that help you earn rewards

For example, if you are new to credit or have a damaged credit report, then opt for a secured credit card. Here, you have to pay a certain amount as a security deposit, which is returned to you when your account is upgraded. Likewise, if you want to save on interest, then a low-interest credit card or balance transfer card might be the best fit. Lastly, if your aim is to get more incentives and points, a reward-oriented credit card will do the trick. These cards have a high APR but offer larger sign-up bonuses and give you points, miles, or cash back on every NOK spent.

- Cinch Your Choices by Asking the Right Questions:

The third step to find the best credit card in Norway is to perform a stellar filtration process by asking the right questions. For example, if your priority is a secured credit card for credit repair, then you should be asking yourself questions like ‘will the card help in building the credit report?’ and ‘what is the annual fee of opening an account?’ and so forth. Similarly, if your priority is a low-interest 0% APR credit card, then some relevant questions would be ‘what is the card’s balance transfer policy?’ and ‘how long is the 0% APR policy?’ and likewise. Lastly, for a reward-based card, you should ponder on aspects like ‘how do I spend my money?’ and ‘how quickly will I earn my rewards?’ and the like.

- Apply for a Credit Card that Pledges the Highest Value:

Last but not least, the key while applying for the most relevant credit card is to compare, contrast, and go for the best-value option. For example, the best secured credit cards in Norway are those that let you increase your limit after a few consecutive on-time payments and place your security deposit in an interest-accruing CD. Simultaneously, the distinguishing feature of a 0% APR card is waiving off of late fees or penalty APR. Thirdly, for reward-oriented credit cards, the highlight features include lower required spending to earn points and incentives and no expiry date on rewards.