Securing Loans in Norway: A Financial Guide for Expats

It looks like you have recently moved to Norway and plan to stay here for a few months or years. Well, congratulations. Now that you are settled in this country, it’s time to know about the loans you can get here for your different needs. So, go through this guide and explore different types of personal loans you can get in Norway, including home loans, educational loans, car loans, and more.

Be aware that Borrowing money costs money

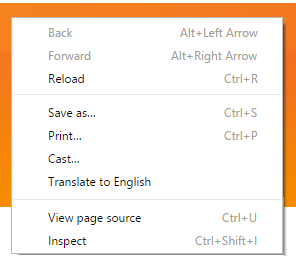

TIP: when you land on a website of a Norwegian loan provider, make a right mouse-click anywhere on the page (Only works with Google Chrome browser!). A small dropdown menu will appear and then it will say; “translate this page to English” (or any other language). This will make it better understandable and easier for you to make the right decision!

TIP: when you land on a website of a Norwegian loan provider, make a right mouse-click anywhere on the page (Only works with Google Chrome browser!). A small dropdown menu will appear and then it will say; “translate this page to English” (or any other language). This will make it better understandable and easier for you to make the right decision!List of loan providers in Norway

All these loan providers offer different rates and different conditions for different prices. Comparing the specifications of each loan provider can be time-consuming. We have prepared a list to compare below.

| Clear terms | Borrowing Range | English-speaking customer service | |

|---|---|---|---|

| › Ferratum.no | ✓ | 1000 – 50,000 NOK | ✓ |

| › Arcadiafinans.no | ✓ | 5000 – 600,000 NOK | ✓ |

| › Financier.no | ✓ | 25,000 – 600,000 NOK | ✓ |

| › Kredittlanet.no | ✓ | 45,000 – 450,000 NOK | ✓ |

What is the necessity of loans in Norway for ex-pats and foreigners?

When you move to a new country, you need to settle down there with the basic accommodation as well as other essential things like a car, furniture, school and colleges for your kids, etc. As a result, you need to invest money in vital things. But, investing your own money is not a great solution as a newly moved ex-pat in a country. So, it is when you have to get your hands on loans, which refers to a particular amount of money you need to repay to the lender with a particular interest rate.

If you have recently moved to Norway and need to buy an apartment, a car, or some other personal things, you can always opt for a loan in Norway from different banks and private lenders as long as you have a good credit score. Additionally, you can explore different personal loan interest rates in Norway and get your hand on both personal loans and loans for commercial and business purposes.

Personal loan in Norway

In Norway, you always get the opportunity to take personal loans from different lenders for your personal requirements, including home loans, car loans, educational loans, and more. Whether you come from a different country or Norway, you can take loans from Norwegian banks.

Please note that the Norwegian government has set strict rules and has issued legal guidance on how all personal credit can be advertised. Do not forget to take help from loan calculator Norway to measure the interest rates of different private loan providers in this country.

Home loan in Norway

Buying a home after moving to a new place is a must if you plan to stay here forever or for a few years. It is when you need to take help from a Norwegian home loan. Several banks offer home loans in Norway to people. All of them are extremely ex-pat and foreigner-friendly. Bank Norwegian Nettbank, the Norwegian State Housing Bank, Norway Savings Banks, etc., are some banks from which you can get loans for mortgages at different interest rates with different terms and conditions.

Car loan in Norway

A car is probably the second important thing you must get your hands on after buying a home. Whether you are looking for a brand new or a used vehicle in Norway, you can get different car loans for all purposes. You can get great deals on car loans Norway from banks and private lenders for different types of vehicles, including trucks, SUVs, passenger cars, delivery vehicles, and more. In this country, the interest rate of a car loan may vary from 3.25% to 7% per annum.

Educational loan in Norway

According to the Norwegian State Educational Loan Fund, you must be a citizen of Norway in order to get your hands on loans for educational purposes. However, as an ex-pat or foreigner, you can also get the opportunity to receive an educational loan as long as you have foreign citizenship. In this country, you can get different types of educational loans for your upper secondary education, higher secondary education, and other diploma and degree courses. With the money, you can buy books, stay in hostels, and get admitted to academic institutions.

How to get a loan in Norway?

Norway, being an extremely ex-pat-friendly country, offers loans for different purposes to everyone. Noticeably, there are no strict guidelines or restrictions for foreigners who buy property for the first time. For instance, they can borrow 100% of the purchase price while buying a mortgage. However, for taking loans from banks in Norway, you have to follow the procedure noted down below.

- Firstly, open a bank account with your nearby Norwegian Bank

- Provide the bank with your tax returns and payslips as a proof of your income

- Provide the lender with your residential permit and address proof

- Get ready with your identity proof