Navigating Mortgages in Norway for Expats

Navigating the world of mortgages in Norway can seem like a daunting task, especially for expats. Norway is a popular destination for people from around the globe looking to call it home. However, understanding the nuances of acquiring a mortgage in a new country can be challenging. This guide aims to demystify the process, providing expats with all the information needed to make informed decisions about mortgages in Norway.

Understanding the Norwegian Mortgage Market

Norway’s mortgage system might differ significantly from what expats are accustomed to in their home countries. Norwegian banks are known for their thoroughness in assessing mortgage applications, focusing on the applicant’s financial stability and ability to repay the loan. Interest rates in Norway have historically been low, making mortgages relatively affordable for those who qualify.

Eligibility Criteria for Expats

To be eligible for a mortgage in Norway, expats must have a stable income and a Norwegian personal identification number (D-nummer or fødselsnummer). Banks will also look at your employment history, length of residence in Norway, and credit history. It’s essential to have all your financial documents organized and ready to present to the bank.

If you are looking for a home we can recommend Tjenestetorget.no where you can get offers from several estate agents.

The Process of Applying for a Mortgage in Norway

The first step in applying for a mortgage in Norway is to gather all necessary documentation. This includes proof of income, employment contracts, tax returns, and any other financial statements that prove your financial stability. Expats should also prepare to provide a detailed account of their credit history.

Choosing the Right Bank and Mortgage Type

There’s a variety of banks and financial institutions in Norway that offer mortgages to expats. It’s crucial to shop around and compare offers to find the best rates and terms. Mortgages can be fixed-rate or variable-rate, and deciding which is best for you will depend on your financial situation and preferences.

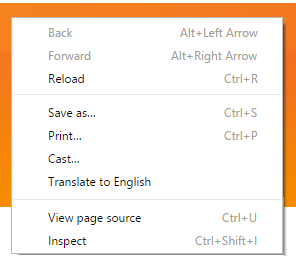

TIP: when you land on a website of a Norwegian mortgage company, make a right mouse-click anywhere on the page (Only works with Google Chrome browser!). A small dropdown menu will appear and then it will say; “translate this page to English” (or any other language).This will make it better understandable and easier for you to make the right decision!

TIP: when you land on a website of a Norwegian mortgage company, make a right mouse-click anywhere on the page (Only works with Google Chrome browser!). A small dropdown menu will appear and then it will say; “translate this page to English” (or any other language).This will make it better understandable and easier for you to make the right decision!

Be aware that Borrowing money costs money

Below, we have listed 3 reliable mortgage service providers that operate in Norway:

Eiendomsfinans

Eiendomsfinans is an excellent choice for expats in Norway looking to navigate the mortgage process. They offer an English website, which makes it easier to understand for non-Norwegian speakers. They streamline acquiring mortgage offers from several banks, offering a free service that includes personal guidance from a dedicated advisor. This ensures expats receive tailored advice and the most competitive loan options. Their extensive experience and wide network of financial partners simplify what can often be a complex process, making them a trusted ally for expats seeking to purchase property in Norway.

ZenFinans

ZenFinans offers personalized mortgage services that are tailored to individual financial needs, making it a great option for expats in Norway. Their process is designed to be quick and easy, providing free and non-binding assistance. They help with new mortgages, refinancing, and offer special “restart loans” for those with financial challenges. ZenFinans simplifies the application process by submitting a single application to up to 10 banks, ensuring clients receive the best financial solution among their partner banks.

TFinans

TFinans stands out for expats by handling mortgage or refinancing negotiations with multiple banks, offering a service that’s free and non-binding. Unlike Eiendomsfinans, which emphasizes personalized advisor support, TFinans focuses on facilitating a wide range of banking options to find the best solution for the individual’s financial situation. This approach can save expats significant time and money, offering a streamlined application process with expert review and assistance in choosing the right offer, catering to the unique needs of expats in Norway’s property market.

Important Considerations for Expats

The property market in Norway can be highly competitive, especially in urban areas like Oslo and Bergen. Prices vary widely depending on the location and type of property. Expats should research the market thoroughly to understand what they can afford and where they might want to live.

Navigating Legal Requirements

There are specific legal requirements and regulations in Norway that expats must be aware of when purchasing property. This includes understanding the process of registering the property and any taxes or fees that may be applicable. It’s advisable to consult with a legal professional who specializes in Norwegian property law.

How Do Expats Overcome the Legal and Financial Hurdles of Buying a Property in Norway?

Expats can overcome the legal and financial hurdles of buying property in Norway by taking a structured approach to understanding and navigating the country’s property laws, mortgage application process, and the financial implications of such an investment. Here are key strategies:

- Understanding the Legal Framework: It’s crucial for expats to familiarize themselves with Norwegian property laws, including the process of registering property ownership and any restrictions that might apply to foreign buyers. Consulting with a legal professional who has experience in Norwegian property law is advisable to navigate this complex area.

- Financial Planning and Budgeting: Before embarking on the property buying process, expats should have a clear understanding of their financial situation, including their budget for purchasing property and the additional costs involved, such as taxes, fees, and insurance. This includes understanding the total cost of ownership beyond the purchase price.

- Securing Financing: Obtaining a mortgage as an expat requires thorough preparation, including gathering all necessary documentation such as proof of income, employment status, and any assets or liabilities. Expats should also work on building a local financial footprint, such as opening a Norwegian bank account and establishing a local credit history, if possible.

- Navigating the Mortgage Application Process: Expats should research the different banks and financial institutions offering mortgages to foreigners and compare the terms and interest rates. Employing the services of a mortgage broker can also provide valuable assistance in finding the best mortgage deals available for expats.

- Dealing with Taxes and Fees: Understanding the tax implications, both at the time of purchase and during ownership, is critical. This includes transfer taxes, property taxes, and any potential tax benefits for which they might be eligible. Consulting with a tax advisor who understands the nuances of the Norwegian tax system for foreigners can provide significant benefits.

By meticulously planning and seeking the right professional advice, expats can successfully navigate the legal and financial hurdles associated with buying property in Norway, making the process smoother and more manageable.

Why Do Interest Rates for Mortgages in Norway Vary for Expats Compared to Locals?

Interest rates for mortgages in Norway can vary for expats compared to locals due to several factors that banks and lending institutions consider when assessing risk and determining loan terms. Firstly, expats may be perceived as higher risk borrowers due to their potentially less stable residency status and shorter financial history within Norway. This can lead to higher interest rates as a form of risk compensation for lenders.

Another reason for the variation in interest rates is the difference in credit history accessibility. Locals typically have a long-standing credit history within Norway, making it easier for banks to assess their creditworthiness. Expats, on the other hand, might have a limited or non-existent credit history in Norway, even if they have an excellent credit score in their home country. This lack of local credit history can result in less favorable interest rates.

Additionally, employment status and type of employment can also influence interest rates. Expats often have employment contracts that are fixed-term or linked to specific projects, which may be viewed as less secure compared to the permanent employment contracts held by many locals. This perceived job insecurity can lead to higher interest rates for expats.

To secure the best rates, expats can take several steps, such as building a local credit history by using credit cards or small loans, ensuring stable employment, and providing a significant down payment to lower the loan-to-value ratio. Moreover, working with mortgage brokers who specialize in assisting expats can also help in navigating these challenges and securing more favorable mortgage terms.

Conclusion

While the process of securing a mortgage in Norway as an expat can seem overwhelming, being well-prepared and informed can make all the difference. By understanding the basics of the Norwegian mortgage market, gathering necessary documentation, and seeking professional advice, expats can navigate this process successfully. With the right approach, owning a home in Norway can become a reality, offering a stable and rewarding life in this beautiful country.