Your Guide to Navigating Insurances in Norway: A Must-Read for Expats

Norway, known for its stunning fjords, northern lights, and high quality of life, attracts expats from all corners of the globe. Moving to a new country comes with its share of challenges, and understanding the local insurance landscape is crucial for a smooth transition. This comprehensive guide is tailored specifically for expats living in Norway, providing you with all the essential information you need to navigate insurances in this beautiful Nordic country.

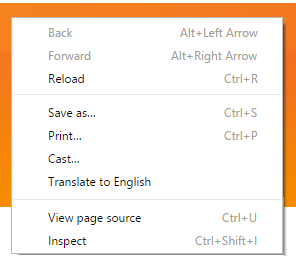

TIP: when you land on a website of a Norwegian insurance provider, make a right mouse-click anywhere on the page (Only works with Google Chrome browser!). A small dropdown menu will appear and then it will say; “translate this page to English” (or any other language). This will make it better understandable and easier for you to make the right decision!

TIP: when you land on a website of a Norwegian insurance provider, make a right mouse-click anywhere on the page (Only works with Google Chrome browser!). A small dropdown menu will appear and then it will say; “translate this page to English” (or any other language). This will make it better understandable and easier for you to make the right decision!Understanding the Basics of Insurance in Norway

Norway boasts a robust social welfare system, ensuring that residents have access to essential healthcare services. However, relying solely on public services may not cover all your needs, especially as an expat. This is where understanding the local insurance market becomes invaluable.

Health Insurance: The Cornerstone of Your Stay

Upon registering with the Norwegian National Population Register and acquiring a Norwegian identification number, you’re automatically covered by the Norwegian National Insurance Scheme (Folketrygden). This public health insurance offers comprehensive coverage, including general practitioner visits, hospital treatments, and even certain medications.

However, many expats opt for additional private health insurance for quicker access to specialists, private hospital care, and international coverage. This is particularly advisable for those with specific health needs or those who travel frequently.

Tjenestetorget

Tjenestetorget is a comprehensive comparison platform established in Norway in 2004, aimed at assisting individuals, including expats, in making more informed and financially savvy decisions. It offers a unique comparison service that connects users with over 500 suppliers across Norway and Denmark, facilitating more than 1 million users to date. The platform is particularly beneficial for expats navigating the complexities of services in a new country, providing a centralized place to obtain competitive offers across a wide range of services, including insurance, financial services, and more

Home and Contents Insurance: Protecting Your Norwegian Home

Whether you’re renting a cozy apartment in Oslo or have bought a picturesque cabin by the fjords, home and contents insurance is essential. It not only covers damage to the building but also protects your personal belongings from theft, fire, and water damage. Given Norway’s high living costs, replacing lost or damaged items can be expensive without adequate coverage.

Car Insurance: A Must for Exploring Norway’s Scenic Routes

If you plan to drive in Norway, car insurance is mandatory. At a minimum, you’ll need third-party liability insurance, but many expats choose comprehensive coverage for additional protection against theft, natural disasters, and road accidents. Considering Norway’s challenging driving conditions, especially during winter, such coverage provides peace of mind.

What types of insurance are mandatory for expats living in Norway?

For expats moving to Norway, understanding the mandatory insurance requirements is crucial for ensuring legal compliance and peace of mind. In Norway, there are several types of insurance that are considered essential:

- Health Insurance: Once registered in the Norwegian National Insurance Scheme (Folketrygden), expats are entitled to the same health coverage as Norwegian citizens. This registration typically happens automatically when you work or have legal residence in Norway. For those not automatically covered, purchasing private health insurance is advisable to ensure access to healthcare services.

- Car Insurance: If you own or plan to own a vehicle in Norway, third-party liability insurance is mandatory. This insurance covers damages or injuries to others in an accident where you are at fault. Many expats also opt for comprehensive coverage to protect against theft, vandalism, and accidents.

- Occupational Injury Insurance: Employers in Norway are required to have occupational injury insurance for their employees. This insurance provides coverage for injuries or illnesses contracted as a result of work activities.

- Home Insurance: While not legally mandatory, home insurance is highly recommended and often required by landlords for rental properties. It covers damage to the property, theft of possessions, and sometimes liability for injury to others on the property.

Understanding these requirements and ensuring you have the appropriate coverage is the first step toward a secure expatriate life in Norway. It’s also a good idea to consult with an insurance professional who can provide advice tailored to your specific situation.

Why is health insurance coverage critical for foreigners in Norway, and how does it differ from the public health system?

Health insurance coverage is vital for foreigners in Norway for several reasons. Firstly, while Norway’s public health system offers comprehensive care to residents, including expats who are registered and contribute to the Norwegian National Insurance Scheme, there are scenarios where additional coverage is beneficial:

- Access to Private Healthcare: Private health insurance can offer faster access to specialists and elective procedures, reducing waiting times compared to the public system.

- Coverage Abroad: For expats who travel frequently, either back to their home country or internationally, private health insurance can provide coverage outside of Norway, which the public system does not cover.

- Additional Services: Private insurance may cover services not included in the public system, such as certain dental treatments and physiotherapy.

The public health system in Norway is funded by taxation and provides comprehensive care to all residents. Once registered, expats have access to this system. However, the coverage is primarily within Norway, and there might be limitations for services that are not deemed medically necessary.

Navigating Life Insurance and Pension Plans in Norway

Life insurance is an aspect many expats overlook, yet it’s crucial for protecting your loved ones. Norway offers various life insurance policies, including term life and whole life insurance, catering to different needs and life stages.

For pensions, expats working in Norway contribute to the Norwegian Public Service Pension Fund, ensuring retirement benefits. However, supplementing this with a private pension plan is a wise choice, especially for those who may not spend their entire careers in Norway.

Tips for Choosing the Right Insurance in Norway

Selecting the right insurance policies can be daunting, but here are some tips to guide you:

- Research thoroughly: Understand what each policy covers and compare offers from different providers.

- Consider your specific needs: Tailor your insurance coverage to your lifestyle, health condition, and financial situation.

- Seek advice: Consult with insurance advisors who have experience with expat clients.

- Read the fine print: Be aware of any exclusions, deductibles, and coverage limits.

Making the Most of Your Time in Norway

Living in Norway as an expat is an enriching experience, offering a unique blend of natural beauty, cultural richness, and high living standards. While the thought of navigating insurance in a new country might seem overwhelming, it’s an essential step in ensuring your peace of mind during your Norwegian adventure.

By familiarizing yourself with the local insurance landscape and making informed choices, you can protect yourself, your family, and your belongings against unforeseen events. This guide aims to empower you with the knowledge you need to confidently navigate insurances in Norway, letting you focus on enjoying all the incredible experiences this country has to offer.

Welcome to Norway, where your new life awaits, safeguarded by the right insurance choices.